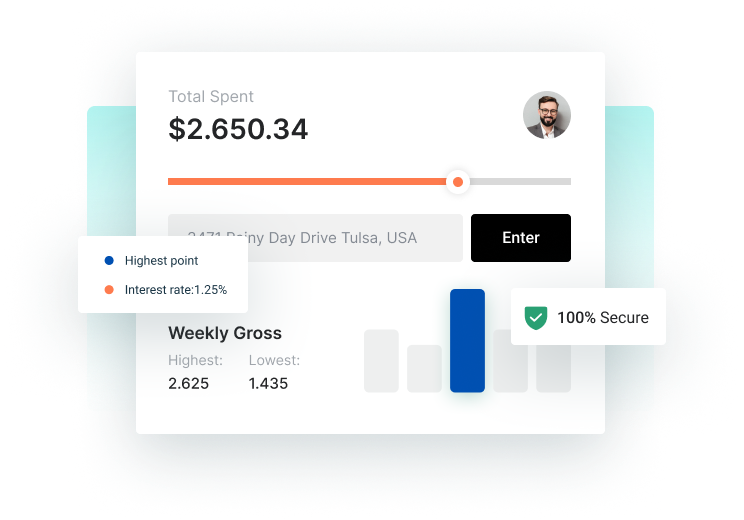

SBA Loans, Bank Loans

24-48 Hour Funding, Minimal Stipulations, Unsecured Financing, Flexible Terms & Rates

New & Used, Private Party Sales

SBA lending refers to government-backed loans provided by the U.S. Small Business Administration (SBA) to help small businesses secure funding with favorable terms

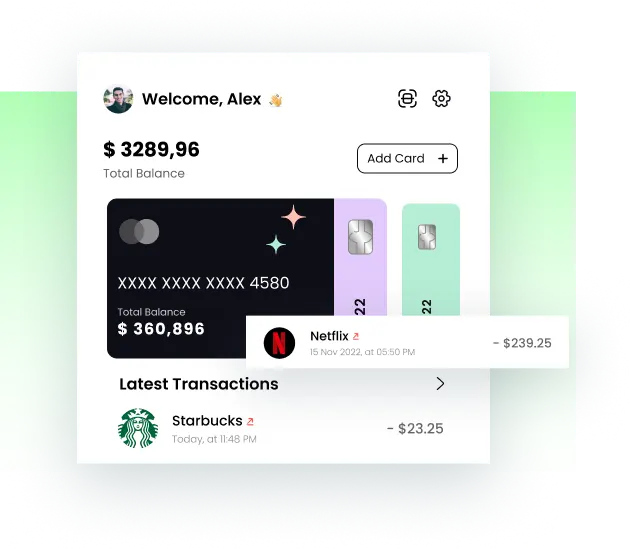

Cash on hand, when you need it. Revolving line. Borrow + Repay with flexible rates & terms.

Payment processing solutions with your business in mind

Start building a credit history with every dollar your business spends.

M&A can help companies expand their market share, gain access to new technologies or resources, and achieve economies of scale.